Search

Arabic

Platform

Resources

Company

Sign in

Contact us

Discover innovative financial solutions with CreditPlus

Find out more

Contact our sales team

Buyer

Buyer

Supplier

Connectivity that speeds up your working capital

We fully understand the broader ERP ecosystem, so everything fits together intuitively within your native environment, SAP or otherwise.

Bank

Payables

Free up cash through your supply chain with a solution that flexibly combines the power of Supply Chain Finance, Factoring, and Dynamic Discounting.

Recievables

A single, user-friendly platform for turning your accounts receivable into cash to improve your balance sheet and insulate against inflation.

Inventory

Assure supply, preserve cash, and improve on-time customer delivery.

For Suppliers

Get paid early

Receive early payment from your customers on outstanding receivables and use the cash to meet your working capital needs.

Access cheaper financing

By leveraging on the buyer risk and credit limit offered by the funders

Create predictability in collections

Financing your business isn’t always easy. Many traditional methods involve significant amounts of paperwork and, if you’re a small business, you may not have access to the funds you need.

For Corporate Buyers

Strengthen & grow relationships with all

– not just key – suppliers

Extend payment terms & improve commercial terms

For Banks & Funders

Offer short-term finance based on an irrevocable payment undertaking

Attract & retain key clients with flexible working capital products

Strengthen long term relationships

Access new opportunities

Reverse Factoring

WE enable suppliers to sell their receivables to funders without recourse

Dynamic Discout

We enable suppliers & buyers to get better terms

Factoring

Our Services

We enable suppliers to get cash from funders

What is Reverse factoring?

Payables Finance – or Reverse Factoring – allow buyers offer an early payment option to their suppliers based on approved invoices.

Suppliers sell/reassign the invoices to a third-party funder in exchange for a discounted early payment. Buyers then pay the full invoice value to the third-party funder on maturity date - typically under an Irrevocable Payment Undertaking.

Linking a buyer, their supplier, and a funder, Payables Finance reduces the corporate’s supply chain risk and expands the supplier’s finance options.

How it works ?

6

Pay full invoice value at maturity date of invoice

3

Invoice approval +

Payment instructions

Buyer

Funder

4

Offers early payment

2

Order delived & invoice issued

If supplier chooses early payment, funder purchases/assigns receivables & Pays discounted value

5

1

Submit order

Supplier

Why Choose us?

End - to end customer onboarding

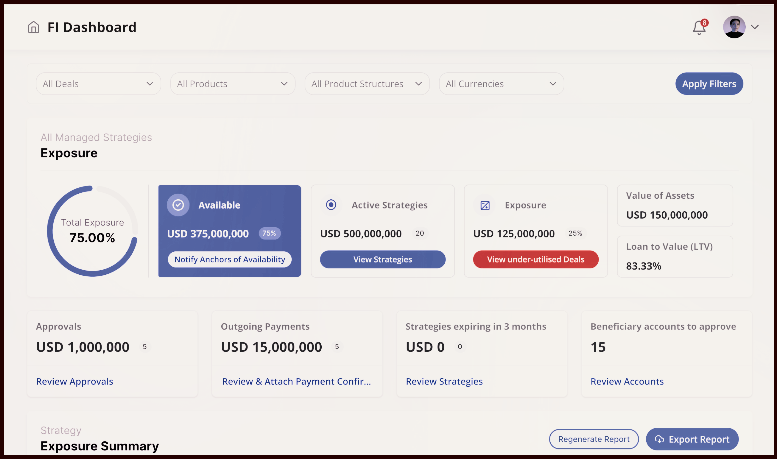

Dashboards & Reporting

internal workflows & control

APIs connection

Customer-facing portals

Automatic reconciliation

Frequently asked questions

How do I get started with Credit Plus?

Getting started is easy. Simply sign up on our platform, complete the required registration details, and verify your business information. Once your account is set up, you can start managing your invoices, selecting financing options, and optimizing your cash flow.

What fees are associated with using Credit Plus?

Our platform is designed to be transparent with no hidden fees. The costs depend on the type of financing you choose and the terms agreed upon. We offer competitive rates and provide a detailed breakdown of any costs before you commit.

How long does it take to receive funds once an invoice is approved?

Once an invoice is approved on our platform, funds can typically be disbursed within 24 to 48 hours, ensuring you have quick access to the working capital you need.

Can I use Credit Plus if my business is located outside Jordan?

Currently, our platform focuses on businesses within Jordan. However, we are looking to expand to other markets in the MENA region soon.

How does Credit Plus ensure transparency and trust among all parties?

Our platform is built on transparency and trust. We provide real-time tracking of transactions, clear communication, and full visibility into the financing process for all parties involved. Additionally, we partner with reputable financial institutions and investors to ensure the highest standards of service.

How can Credit Plus help my business?

Credit Plus simplifies the supply chain financing process by offering a digital platform that allows businesses to manage all their invoice financing needs quickly and efficiently. Whether you're a small or medium-sized enterprise (SME) or a large corporation, we provide flexible financing options that improve cash flow, enhance supplier relationships, and promote growth.

Who can use Credit Plus?

Our platform is designed for SMEs, large corporations, suppliers, and investors looking to optimize their working capital. If you are a business looking to manage cash flow better or a supplier seeking early payments for invoices, Credit Plus can help.

What types of financing are available on the platform?

We offer a range of supply chain finance solutions, including invoice factoring, reverse factoring, and dynamic discounting. Each solution is tailored to meet the unique needs of businesses and suppliers, ensuring maximum flexibility and benefits.

Is my data safe on your platform?

Absolutely. We take data security seriously and implement the latest encryption technologies and security measures to protect your information. All transactions on our platform are secure and comply with relevant data protection regulations

Contact our team

079 600 8 900

info@credit-plus.me

King Hussien Business park

Bldg7, Amman - Jordan